In this week’s issue, we analyze the fastest-growing multifamily markets in 2022.

The Story

Over the past few weeks, we have seen new reports of various multifamily growth trends, and the markets that are likely to grow fastest. Last year was a blockbuster one for multifamily investment. New CBRE data shows that multifamily investment volume jumped 73% in Q4, setting an annual record with an investment volume of $335 billion total in 2021. This almost doubled since 2019, which was also a record at the time of $193 billion.

Real estate however is a local game, and some markets have outperformed others. So which markets are poised for growth in 2022? We are so glad you asked.

Swiftlane + Costar: Fastest growing markets

Alongside Costar data, Swiftlane starts us off with the 5 fastest-growing multifamily development markets:

- Dallas, TX: The region jumped from 41,303 units under construction in 2020 to 109,339 units under construction in 2021 – a 165% increase.

- Phoenix, AZ: Units under construction jumped from 44,788 in 2020 to 104,444 in 2021.

- Austin, TX: In the past year, Austin has doubled its construction starts by unit and is estimated to deliver 15,827 units in 2022.

- Atlanta, GA: Atlanta has seen the largest jump in units under construction with 74,988 units under construction in 2021, a 324% increase from 2020.

- Nashville, TN: Just under 60,000 multifamily units were under construction in Nashville in 2021, which is a 211% increase from 2020.

Learn more about these markets here.

Globe St + Redfin: Fastest rent growth

Globe St reports using Redfin data on the top metros with the fastest-growing rents:

- Austin, TX (▲ 40%)

- Nassau County, NY (▲35%)

- NYC, NY (▲ 35%)

- Newark, NJ (▲ 35%)

- New Brunswick, NJ (▲ 35%)

Using Census data, Andrew DePietro of Forbes talks about the top cities where the share of renters has increased the most between 2014 and 2019:

- Frisco, TX (increase of 56%)

- Fishers, ID (53%)

- Palm Coast, FL (44%)

- McKinney, TX (43%)

- New Braunfels, TX (37%)

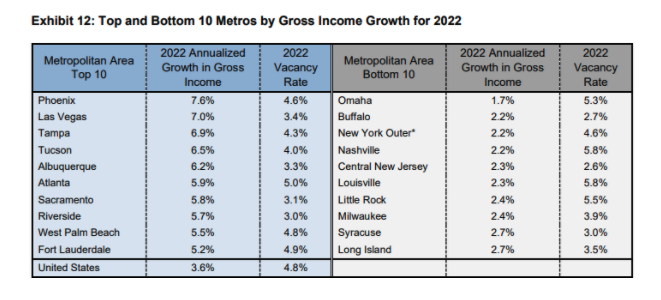

Freddie Mac recently released its 2022 Multifamily Outlook report showing the top and bottom 10 metros by gross income growth for 2022:

According to data a few weeks ago from Zillow, Tampa will be the hottest marketing in 2022. “Tampa is expected to rise from fourth-fastest home value growth in 2021 to fastest in 2022, Raleigh from third to second and Jacksonville from seventh to third. The fastest-growing markets in 2021, Austin and Phoenix, are expected to fall to seventh and eighth, respectively.”

U-Haul released its 2021 migration data, showing growth markets that real estate investors should take note of, starting with Kissimmee-St. Cloud. Arrivals to this market jumped 31% last year as it took the top spot. Rounding out the rest of the list for top growth cities were Raleigh-Durham, NC in second place and Palm Bay-Melbourne, FL in third.

Finally, last week CrowdStreet released its 2022 Best Places to Invest report, which takes “all property types into account…But to make the top 20, a market must consistently rank highly across multiple real estate classes.”

Expert Take

“Although the multifamily market has held up well, many investors are still sitting on the sidelines. As the economy begins to recover and the pandemic is brought under control, institutional and value-add buyers should become much more active next year, with foreign buyers also increasing their investment activity in the US.”

– Crexi

“We expect the vacancy rate to improve in more than 40% of the markets we cover. In 2022, gateway and some Rust Belt markets are expected to see improving vacancy rates. The largest projected drops in vacancy are concentrated in the Northeast and Mid-Atlantic, such as Washington, D.C. (core) and Boston, where vacancy rates are expected to decline 160 and 130 bps, respectively.” – Steve Guggenmos, VP Research & Modeling, Freddie Mac

So What?

Texas and the Sunbelt markets had an especially good 2021, and look poised for another one. Arizona markets also feature prominently among the above lists. It’s important as we move into inflationary periods that as investors we are conscious that growth markets also see the highest levels of inflation. Keep a close eye on wages in your market, because if they don’t keep up then there will be downward pressure on NOIs and valuations.

This Week’s Top Headlines

- National home seller profits sat at $94,092 in 2021, up 71% from 2019 – Realtor

- Commercial property sales sat at $809 billion for 2021, nearly double 2020’s total, and surpassed the previous 2019 record of $600 billion – WSJ

- Blackstone doubled its net income to $2.9 billion from $1.8 billion in Q4 2021, with its CEO stating “Today Blackstone reported the most remarkable results in our history on virtually every metric” – TRD

- The Fed is poised to move forward with a rate increase in the next few months – RISMedia

- As such, consumers are locking in rates. Mortgage refinance applications jumped 18% week-over-week but is still 50% lower than the same time last year – CNBC

- National median rent jumped to $1,781 in December 2021, capping a 10.1% annual rent growth last year. Miami, Tampa, and Orlando, saw gains of 34% or more – Realtor

- In the coming weeks, Goldman Sachs will unveil its plans to bring employees back into the office – TRD

Weekly Chart

The markets with the most inward migration tend to have higher inflation, according to new data from Redfin. The influx of people puts upward pressure on costs such as housing, utilities, and transportation.

Have Questions?

Get in touch with our team to learn more about what Swiftlane can do for you.