The National Multifamily Housing Council (NMHC) recently released their 2022 Renter Preferences Survey Report. Over 221,000 renters were surveyed across 4,564 properties and 79 markets. The results reveal key trends and findings that will determine the direction of the multifamily and rental industry in the upcoming years.

Table of contents

- Renters Are On The Move

- Property Tours Look Different

- Packages Are A Priority

- Connectivity Is More Important Than Ever

- Access Control As An Amenity

Also, read

- Best Video Intercom Systems

- Offer Contactless Tours With Swiftlane

- The Future of Access Control

- Apartment Intercom System with Door Release

We’ve collected the main highlights and interpretations that will impact multifamily owners and investors. Based on renter demographic trends, tenant preferences, building experience, and smart building technology applications, owners can better understand their renters to make data-informed decisions that will improve their properties to drive the highest revenue and return.

Renters Are On The Move

The flexibility to live anywhere onset by the adoption of remote work has made the rental lifestyle the most attractive it has ever been. With increasing rental activity and mass migrations to up and coming areas with affordable rent and job growth, it’s critical to capture and interpret what renters are doing. Predictive insights based on renter behavior and preference help to identify multifamily development trends, future market performance, growth, and ultimately revenue-generating opportunities.

Of the renters surveyed, 26% said they will be moving to a different rental location upon expiration of their lease. The top reasons for this shift are seeking lower rents (49%), better community amenities (29%), and more living space (28%). Those moving and relocating to a new city is up to 17% from 13% in 2020.

A shift to remote work due to the pandemic has also had a significant impact on rental activity with 25% of survey respondents citing it as an influence on their move. With this in mind, it will be important for owners and operators to continue to track remote work trends to anticipate rental trends. Currently, 27% of renters work from home every day, and another 23% of renters work from home at least one day a week. Only 38% of renters never work remotely.

Property Tours Look Different

Just as renters want flexibility with where they live, they also want the flexibility to tour those communities. Many times, renters are restricted by the schedules and availability of leasing professionals and office hours. With self-guided tours, renters have the ability to gain secure access to the property and rental unit at their convenience without the supervision of property staff. With 76% of renters indicating the weekend as the best time for them to tour a property, offering a self-guided touring option will become more and more critical to remaining competitive in the rental market.

The popularity of self-guided tours is evident in the survey responses. In their most recent rental search, 39% of renters toured the property with self-guided touring. In a future rental search, 26% of respondents said they would prefer taking a self-guided tour rather than touring with a community representative. This is up from just 16% in 2020. The benefits to those who prefer self-guided touring include the ability to tour at their own pace, being able to talk freely with a partner or roommate, more convenience with scheduling, and not wanting the representative to “sell” the apartment. Alternatively, the main reason that renters prefer touring with a community representative is the ability to have their questions readily answered and immediate availability of information.

Packages Are A Priority

The volume of tenant packages and deliveries continues to climb. The number of tenants receiving just 1-2 packages per month fell to 21% from 39% in 2020. Those receiving 3-5 packages per month increased from 34% to 39%, and those receiving 6-10 packages per month also jumped from merely 15% in 2020 to 25% this year.

The discussion of package management is not a new one. With the availability and convenience of e-commerce and online ordering, every multifamily building needs a package management strategy that can securely handle the volume of tenant packages. Of the renters surveyed, 73% were interested in secure self-service 24/7 package access such as a package room or package locker. The strength of that interest is reflected in the price a tenant would be willing to pay for such an amenity, which averaged to an additional $37.16 per month. Even more compelling is the 16% of renters who stated that secure self-service package access was a necessity when making their next leasing decision.

Connectivity Is More Important Than Ever

When it comes to renter preferences, the community amenity with the highest amount of interest was reliable cell reception. Of the 86% of survey respondents interested in reliable cell reception, 38% said it was a necessity. The average amount that interested renters would be willing to pay for such an amenity is an additional $42.78 per month. While touring the rental property, nearly half of the surveyed renters check the connectivity of their mobile phones to gauge signal strength.

Also notable is Wi-Fi and internet service connectivity. Upon move-in, 48% of renters said it was absolutely essential to have internet service immediately, while 35% said it was very important. As an in-unit amenity, 62% of renters were interested in pre-installed or managed wi-fi while 54% were interested in property-wide wi-fi.

With remote work more prevalent than ever, and the internet becoming a basic necessity, multifamily buildings will need to continue to explore and implement the best connectivity services for their tenant demographic in order to maintain and improve their living experience.

Access Control As An Amenity

Physical security isn’t something that tenants are willing to compromise. For many, controlled access to the property and its amenities is a necessity that influences their decision to lease. 71% of tenants are interested in controlled property and amenity access with 20% citing it as a necessity when considering whether to rent. Similarly, 65% of tenants are interested in controlled access parking with 28% saying it’s a necessity. The average additional monthly payment that tenants would be willing to make for controlled access to the property, amenities and parking is approximately $36.

With smart home technology becoming increasingly popular, multifamily buildings are beginning to execute smart building technology strategies to give their tenants that same experience. Specifically, innovations in controlled access are guiding smart access initiatives across portfolios as demand from tenants increases.

Keyless smart locks are giving tenants the ability to unlock their unit doors with their smartphones. Tenants no longer have to keep track of a key to their unit, and owners and operators benefit by eliminating the overhead from key management. 59% of tenants said they would be interested in keyless smart locks for their apartments and would be willing to pay an additional $36.72 per month to have it as an amenity.

Biometric access to individual units also sparked the interest of 38% of surveyed renters. While not surveyed by NMHC, controlled biometric and mobile access to the property, amenities, and parking is quickly becoming a mainstream form of Class A property security.

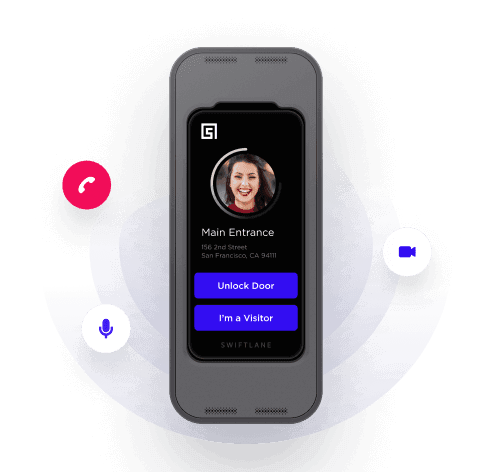

Finally, video intercom systems to manage guests, visitors and deliveries are increasing in demand as a replacement to legacy buzzer systems. Nearly half (48%) of surveyed renters are interested in a video intercom system at the property entrance, with 5% actually citing it as a necessity.

Purchase the full Renter Preferences Survey Report to access all the data collected by NMHC and gain important insights into how to improve your property by attracting and retaining the right tenant demographic.

Have Questions?

Get in touch with our team to learn more about what Swiftlane can do for you.