In this week’s issue, we explore the state of multifamily rents.

This Week’s Top Headlines

We start off with the week’s multifamily insights and then dig deeper into what multifamily rents are doing. Let’s start with the top multifamily stories from this week.

- Inflation: CPI growth pace is slowing, down to 8.3% in April from 8.5% in march — WaPo

- But, Construction Costs Rising: Building material prices jumped 19.2% YoY, and are up 35.6% since the pandemic began — NAHB

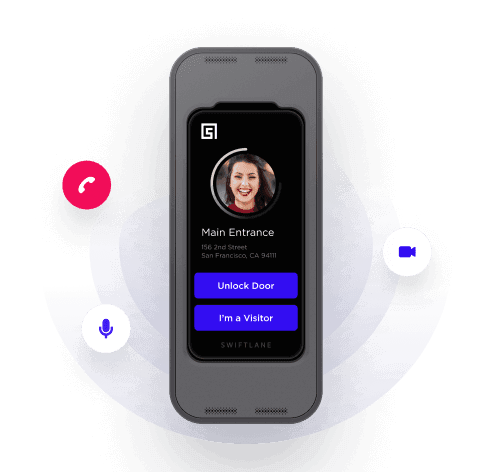

- Let’s Face It: Facial recognition software simplifies tenant experience and access — Globe St

- Permits Up: Single-family builders applied for 1.1 million permits in 2021, 13.9% higher than 2020 levels — NAHB

- Borrowing: For multifamily and commercial was up a whopping 72% YoY in Q1 2022 — MBA

- Therefore: “The strongest apartment fundamentals in a generation mean that the lenders probably aren’t going to put on the brakes in 2022” — Bisnow

- Affordability: Blackstone’s Chief Investment Strategist noted that despite affordability being worse now than in 2007, a crash is unlikely — CNBC

- SFR Growth: Rents grew 13.6% in this asset class in March 2022 YoY, triple the gain recorded in March 2021 — Globe St

Rent Growth Decelerating

Main Takeaway: Rents have seen a significant rise over the past two years. Expect this to moderate as consumer habits change with rising inflation and interest rates. Multifamily investors should have a plan in place to weather rent moderation in the near term.

The Story

According to multiple recent data releases, it appears as though rent growth may have peaked. Here are the data highlights:

- Redfin: Rents increased 15% YoY in April, down from a YoY 17% increase in March. The median monthly asking rent in the U.S. still sits at a record high of $1,962. Austin saw a 46% increase in the same period at the top end, and Milwaukee at -8% at the low end.

- Yardi Matrix: Multifamily rent growth continues to an economic bright spot with the average rent sitting at $1659, rising $15 in April to new all-time highs. Rent growth was positive in all of the top 30 metros both over the last month and year.

- Apartment List: The national rent index was up only 0.9% in April, with rents growing more slowly in 2022 than in 2021. That said, YoY rent growth sits at 16.3%, but the majority of that growth took place last spring and summer. In 2022, rents have only grown a total of 2.5%.

- Zumper: Nationally, rent has risen at a historic pace over the past year, but metros on the West Coast are experiencing sluggish rent growth. Rent prices in most of those metros are now below their pre-pandemic levels.

- Apartments.com: April saw a deceleration of multifamily rent growth. According to the company, “[t]he number of markets witnessing rent growth above 20% has declined from eight at the end of 2021 to just four in April, indicating a tempering of rent growth.”

There’s little doubt that an economic downturn is on the horizon sometime in the next few years. Given the above data, the rapid growth in rents appears to be moderating. As interest rates and inflation continue to rise, renters will have less income to put toward rent.

This will likely place strain on the upper and lower levels of the rental market. Multifamily investors would be wise to stress test their portfolios now to consider the above potential headwinds.

Expert Take

“The fact that rents are growing at a slower pace may be a very early sign that the Fed’s tactic of raising interest rates to quell inflation is working…However, rents are still growing at nearly double the rate of overall inflation. Landlords in hot migration destinations like Austin, Portland and South Florida are charging new tenants 30% more than last year’s rent.” — Redfin Chief Economist Daryl Fairweather

“Despite a recent cool-down, many American renters are likely to remain burdened throughout 2022 by historically high housing costs.” — Apartment List

Chart: Supply Reprieve

According to Zillow, the for-sale supply of housing in the U.S. is increasing slightly, pointing to a more balanced market on this horizon.