Main Takeaway: The multifamily market is cooling, but fundamentals remain strong and robust long-term. It might seem counterintuitive, but now is the perfect time to look inward at our businesses and optimize where we can to de-risk the market downturn. Investors should be focusing on what they can control, such as implementing technology solutions that automate and elevate the tenant experience.

Story: Multifamily demand is cooling according to several new reports this month. RealPage released its demand report for Q3 2022, finding that for the first time in thirty years Q3 demand was negative. Typically, Q3’s are strong leasing periods, and the negative turn is due to “what appears to be a freeze in new household formation.”

Effective rents also saw a quarterly dip of 0.2%, but vacancies remain historically robust at 4.4%. Rent collections are also up to 95.4% in August, a YoY increase from 94.9%.

The Freddie Mac Multifamily Apartment Investment Market Index (AIMI) also showed signs of weakness, dropping 17.9% in Q2 2022 YoY. The index decreased in all 25 markets on both a quarterly and annual basis, driven by record increases in mortgage rates.

According to Steve Guggenmos, vice president of Research & Modeling at Freddie Mac Multifamily:

“The impact of the rapid and substantial increase in both mortgage rates and property prices is evident in this quarter’s AIMI…Although higher rates and property prices have driven the index down, NOI growth remains strong. The drop in AIMI this quarter reflects moderating investment conditions brought about by changing trends in the broader economy. There still exists an overall housing shortage which is keeping vacancy rates low and rents high.”

That said, national NOI growth for multifamily sat at 3%, with the fastest growing market being Miami (4.7%), and the slowest Phoenix (0.5%). But rent growth is decelerating according to reports, with the national average now sitting at $1,718, an increase of 9.4% YoY, down from 20% in 2021.

Positive Signs Despite Multifamily Demand Dropping

Despite the overall market cooling, media reports show that developers are looking to rentals as a near-term solution. According to Globe St., due to rising borrowing costs, many developers are seeing the for-sale market taking a larger hit than rentals. As one developer put it, “the apartment sector is a very different story. As fewer people can afford to buy or they’re not feeling it’s a prudent decision you’ll see more people rent.”

There could be more cooling ahead, with Q4 being a traditionally slow leasing period for apartments. So what should owners and investors focus on?

Technology Helps Multifamily Owners in Cooling Market

In a cooling market, investors need to focus more internally on the departments they can control like marketing and expenses. For the latter, technology is increasingly reducing costs through automation, tenant experience and retention, and efficiencies.

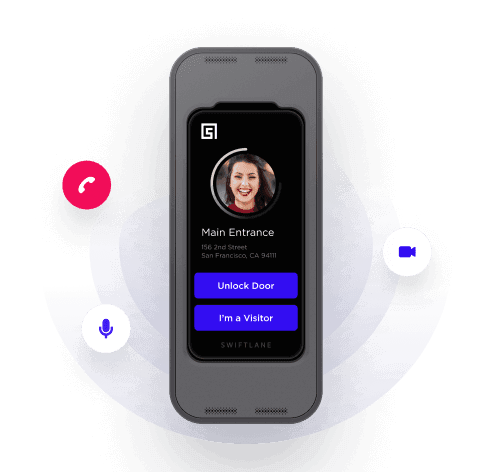

For example, cloud-based smart building access solutions are increasingly the new normal in the multifamily tech stack. Smart access not only helps elevate the resident experience, but reduces operational burdens for property managers, and maximizes NOI for building owners. During a downturn, these types of technology solutions will reduce expenses and ultimately de-risk your potential downside.

Multifamily Market Cooling: Expert Take

“New apartment starts are expected to soon drop from multi-decade highs due to higher financing costs and softening fundamentals. Until then, keep an eye on how quickly and how robust the absorption of newly delivered units is as that may be an indicator of near-term renter appetite – and therefore future demand.” — Jay Parsons, RealPage

“The cooling economy is beginning to show its effect on multifamily…However, key fundamentals remain strong. Despite the flattening rent growth, much about the market remains positive. National asking rents are still at record highs, and national occupancy rates have been hanging around 96% since June of 2021.” — Yardi Matrix