Main Takeaway: Real estate is hyper-local, and some markets are feeling the pain of rising rates, layoffs, and economic uncertainty more than others. The markets that are feeling more distress include: Austin, Chicago, Minneapolis, and tech-centric markets like Seattle and San Francisco.

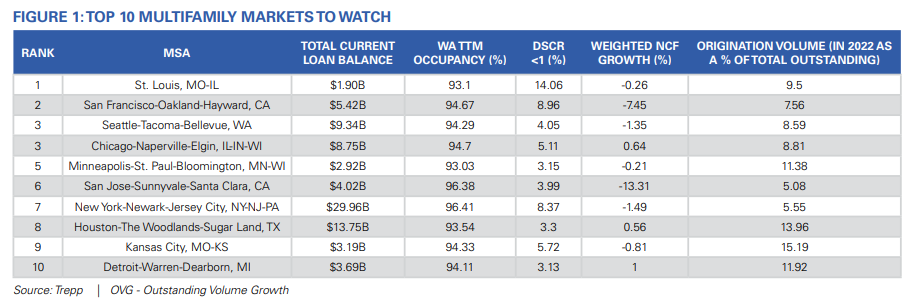

Story: Consumer budgets are being pinched by inflation, and the cost of debt is soaring. Some markets are feeling it more than others, according to new reports. Beginning with Trepp, who ranked U.S. multifamily market distress in the largest metros based on a weighted average rank across various loan metrics.

Here are some more details on the top 5 markets to watch for distress, according to Trepp:

- St. Louis: Approximately 14% of the multifamily properties in St. Louis had a DSCR of less than 1x, the highest percentage among the 50 largest MSAs. The occupancy level in this area was also one of the lowest compared to other MSAs, with a 93% WA TTM occupancy rate.

- San Francisco-Oakland-Hayward: Based in the tech-rich Bay Area, this region has seen sustained trends in remote work, especially in the tech sector, even as the markets move to a post-pandemic normal. With major tech companies cutting costs and conducting mass layoffs, the Bay Area housing market has witnessed some tectonic shifts.

- Seattle: Like San Francisco, the Seattle-Tacoma-Bellevue, WA MSA also houses some of the biggest tech names, with Amazon headquartered in Seattle, Microsoft headquartered in Redmond, and Google’s Seattle office being the second largest global engineering office outside of the Bay Area. The Seattle metro ranks third among the largest MSAs with the most stressed multifamily housing markets.

- Chicago: Prior to the pandemic, Chicago was already known to have one of the highest rates of outbound relocators in the nation, attributed to reasons ranging from high crime rates to high tax burdens. Some of the biggest corporations have been leaving Chicago for these reasons, which may contribute to why the Chicago-Naperville-Elgin, IL-IN-WI MSA lands fourth place in our stressed multifamily markets ranking

- Minneapolis: Home to the headquarters of America’s red bull’s-eye retailer, Minneapolis-St. Paul-Bloomington, MN-WI is the fifth top MSA in our ranking of stressed multifamily markets. About 3% of loans in the MSA had a DSCR of less than 1x. In mid-2022, as other employers returned to their downtown Minneapolis offices, Target, the largest employer in Minneapolis, employing over 12,000 team members in its corporate offices across the Twin Cities, kept its hybrid work approach going.

The above-noted distress is part of the larger economic and real estate cooldown, with investment yields and deal flow slowing. According to Bendix Anderson:

“Investors of all types spent just $6.2 billion to buy apartment properties in January 2023, according to MSCI, Inc., the New York City-based data provider formerly known as Real Capital Analytics. That’s less than half of the monthly volume of deals that closed at the end of 2022, which seemed slow at the time. It’s also 71 percent less than the more than $20 billion in deals closed in January 2022, before interest rates started their relentless rise last year.”

This comes amidst a record number of apartment completions in the pipeline, with over 1 million new rental units under construction. The markets with the largest surge in multifamily construction include:

- Dallas (28,000 units)

- Austin (20,000 units)

- Miami (19,000 units)

- Houston (17,000 units)

- Phoenix (16,000 units)

For commercial real estate as a whole, CRED IQ reported recently on the most distressed CRE markets across the U.S. Out of the 50 largest metros, 28 markets saw MoM drops in the percentage of distressed CRE loans. Further, of the 22 metros exhibiting month-over-month increases in distress, the average increase was 60 bps.

San Francisco (+2.2%), Minneapolis (+2.0%), and Chicago (+1.9%) were the markets that showed the largest percentage increases in distressed CRE loans in March 2023.

RentCafe recently reported on its Rental Competitivity Index (RCI), which shows the multifamily markets that are the most robust regarding rental rates. Here are the top markets:

Expert Take on Distressed Multifamily Markets

“Uncertainty in multifamily may come as a surprise to the market. The Bureau of Labor Statistics reported that total nonfarm payroll employment increased by 223,000 in December and that the unemployment rate dropped to 3.5% for the month. Contrary to what would be expected from this data, this encouraging news is not translating into higher apartment demand. Instead, it seems as though the market should be eyeing trends apart from the job data that we would typically look at for housing market sentiment.” — Trepp CRE Research