Main Takeaway: Labor growth is strong in the apartment and construction markets. That said, retention and hiring remain top priorities for multifamily owners and investors. Human resources and staffing will remain an ongoing challenge amidst higher inflation, remote work demands, and a softening housing market overall.

Story: According to the National Association of Realtors (NAR) data, multifamily construction is on the rise. This is partly due to projects not getting to completion due to supply chain and labor shortages, but overall we have a record number of apartments under construction.

As such, we are seeing an equal increase in construction labor, according to new data from NAHB. Construction sector jobs nationally increased 3.6% YoY in October 2022. Texas had the largest gain of any state, while Louisiana lost the most construction sector jobs. Across the board, most states are gaining jobs in this sector.

Indeed, BLS data shows strong job performance in the apartment market, with all 4 categories of employment increasing in October.

The BLS reported more detailed employment information on four job categories of interest to the multifamily industry. These are employment as residential construction workers, as specialty trades within residential construction, as residential property managers and as lessors of residential buildings.

Despite this rise in employment, many observers do not think it will be enough to keep up with the current production pipeline and demand. According to the Associated General Contractors of America, 91% of construction firms report having trouble filling open positions, with more than 400,000 construction jobs currently unfilled.

Further, according to National Apartment Association Chairman and President Don Bruner, the labor shortage is an “everyday conversation” for the industry, and “at the organization’s June conference, there were extensive discussions of ways to train, recruit and hire staff. The lack of workers to fix broken pipes, repair and flip vacated apartments and perform routine upkeep is just one of the many drags that a nationwide labor shortage has placed on commercial real estate.”

Wages Rise for Multifamily Employees

According to NAHB’s latest Multifamily Market Survey (MMS), in Q1 2022, multifamily employee wages across the board jumped 12% year-over-year. And, this is before we began seeing massive spikes in inflationary pressures.

Recent survey data found that there are strong concerns among multifamily owners and investors concerning hiring and retention. Workforce headcount was the number 2 concern of multifamily professionals, second only to renter experience.

Further, “three-quarters of multifamily corporate teams report they are concerned that today’s labor market shortage will impact their ability to hire and retain leasing teams. And the top challenges identified in the survey focus on the difficulty with hiring, training, and retaining staff.”

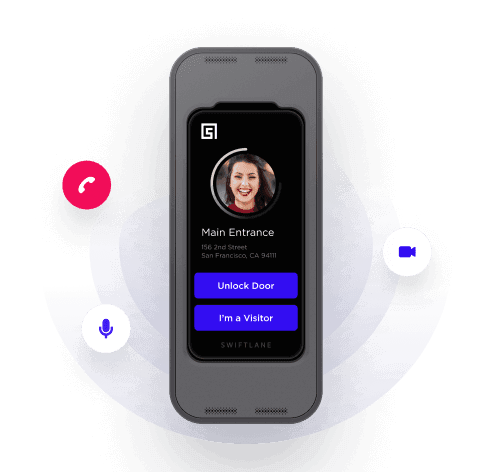

Technology Helps with Multifamily Labor Shortage

With growing staffing challenges, it’s incumbent on owners and operators to leverage technology to automate previously manual tasks, and dramatically improve the renter experience to avoid costly turnover.

According to a recent survey of commercial real estate professionals, there are a slew of manual tasks they would prefer to automate, streamlining company operations and improving employee morale.

Read more here on how technology can help with the labor shortage in the multifamily market.

Expert Take on Multifamily Labor Shortage

“A housing shortage exists and, therefore, more workers are needed in construction…To the degree that more construction workers can get hired via higher wages the better it is for the housing market. But, if home building is constrained because of a lack of workers, then housing unaffordability will continue for a longer period.” — Lawrence Yun, chief economist for the National Association of Realtors

“There is optimism that the labor shortage is improving, and most professionals expect business conditions to recover over the next 12 months. That is excellent news for the industry, but this is surely only the beginning of a revolution in workplace culture. As companies adapt and workers return, commercial real estate technology will continue to be vital for companies to meet new expectations.” — Kelsi Borland, Northspyre

Tell us about your building

and our team will reach out with a quote