Main Takeaway: The tech sector footprint expanded beyond traditional tech hubs as a result of the pandemic and remote work. This makes more rental markets vulnerable to the mass tech layoffs we are currently experiencing. While not a crisis, multifamily owners need to keep a close eye on layoffs in their markets to assess their ongoing risks.

Story: It’s been a rough year for the tech sector. Following over 100,000 layoffs in 2022, we’ve already surpassed that this year with over 120,000 as of March 1st. This, coupled with the staying power of remote work, will have a dramatic impact on the office market and, ultimately, multifamily downstream. Here’s what we need to consider as multifamily owners and investors.

Office Market

In Q4 2022, office leasing activity dropped 57%, with the national office vacancy currently sitting at 12.5% and rising. Given offices are typically on long-term leases, there will be a significant lag effect of the move to remote work, a drying up of VC funding, and mass layoffs.

According to Globe St:

The decline in leasing activity also tracks closely—in opposite directions—to the increase in monthly tech layoffs, which began in Q2 2022 with the first wave of about 30K in tech job cuts, leveled off at that plateau until the end of Q3, and then surged to 74K in layoffs in Q4. It now seems increasingly apparent that a primary reason cited by major tech players in downsizing their office footprints in the first half of 2022—an embrace of remote work—quickly began morphing into an economic necessity as the year progressed.

The economic downturn is not expected to improve before the end of 2023. A survey of global C-Suite executives expects the headwinds to last well into 2024, so the office market is unlikely to improve in the medium term.

Multifamily Markets

With layoffs in major tech hubs, some rental markets may see some headwinds as laid-off employees seek out affordability in other markets. With remote work more normalized, these recently laid-off employees may look for more flexible work in secondary and more affordable rental markets. Uncertainty and unemployment cause people to be more frugal, including on their rents.

REIT Equity Residential CEO Mark Parrell comments on this new reality, noting that these major layoffs have led to “a handful of residents terminating leases early…Possibly the impact is delayed due to severance and other factors, but it is at least equally possible that the workers in these categories are being quickly reabsorbed into the job market.”

Further, although markets like Austin, San Francisco, Seattle, New York, and others are more vulnerable to the impact of tech layoffs, the pandemic saw many companies extend their footprint to smaller and suburban markets.

Focus on Vendors

Finally, one aspect of the tech layoff blitz that multifamily operators should consider is vendors.

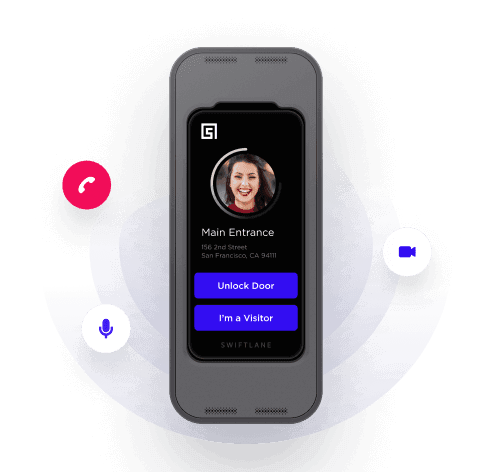

All technology industries are being hard, including those in real estate and property technology. Multifamily operators rely on technology companies, from leasing to turnover to hardware.

Many vendors are vulnerable to the drying up of VC funding, and those that are ingrained in our operations could cause some disruption of service. It’s more important than ever to review your vendor list and choose wisely.

Expert Take on Tech Layoffs and Impact on Multifamily

“With that dispersion, apartment operators around the country will need to stay focused on job loss numbers. Fisher said that UDR’s data analytics team spent time culling Worker Adjustment and Retraining Notification Act (WARN) notices, the legally required notifications of layoffs, and found that tech jobs are being lost beyond San Francisco, Austin and Seattle.” — Leslie Shaver, Multifamily Dive

“Many economists say there is no cause for concern—at least not yet. Nationally, unemployment is still extremely low. And many companies that don’t generally make big headlines are still seeking tech workers. That’s left many economists hopeful that these pink-slipped workers will still be able to find new jobs relatively quickly.” — Clare Trapasso, Realtor.com