Let’s Get Started

In the ever-evolving world of real estate, one term that consistently finds its way into discussions, negotiations, and business strategies is “Capital Expenditures.” For the uninitiated, these two words might seem like complex financial jargon, but as we delve deeper into the realm of real estate investment, you’ll discover that understanding capital expenditures is not only vital but empowering. It can be the key to unlocking the hidden potential and value in your real estate investments.

Capital expenditures, often referred to as “CapEx,” represent those critical investments that property owners and investors make in a real estate asset. These expenditures go beyond the routine maintenance and day-to-day repairs, encompassing larger, long-term enhancements or repairs that directly impact the property’s overall value, longevity, and functionality. Understanding the nuances of CapEx is not just a choice; it’s a prerequisite for anyone seeking to navigate the intricate terrain of real estate.

But why is it so crucial to wrap your head around capital expenditures? In a nutshell, these expenditures play a pivotal role in the financial health of your real estate portfolio. They can significantly impact your return on investment, cash flow, and the overall performance of your properties. Whether you’re a seasoned real estate investor, a novice property owner, or simply someone considering a foray into the real estate market, recognizing the weight of capital expenditures in your financial decisions is paramount.

And that brings us to the purpose of this guide. Our aim is to provide you with a comprehensive roadmap to navigate the complex terrain of capital expenditures in real estate. We’ll demystify the terminology, outline the different types of capital expenditures, and discuss the strategies for budgeting and managing these expenditures effectively. This guide is designed to empower you with the knowledge and tools to make informed decisions, whether you’re considering renovations, improvements, or just want to better comprehend the financial landscape of your real estate investments.

So, whether you’re a seasoned real estate mogul looking to optimize your portfolio, a homeowner planning a major renovation, or an aspiring investor about to take your first leap into the world of real estate, fasten your seatbelts. This guide is your comprehensive companion in understanding capital expenditures in real estate, and it’s about to equip you with the knowledge and insights you need to make strategic and lucrative real estate decisions. Let’s begin the journey towards financial empowerment in the world of bricks and mortar.

Key Takeaways

- Capital expenditures (CapEx) are crucial for maintaining and enhancing the long-term value of real estate properties. These investments cover major repairs, renovations, and improvements that extend the property’s life and attract tenants or buyers.

- Differentiating between capital expenditures and routine maintenance expenses is vital. While CapEx adds value and longevity, routine maintenance keeps the property operational but doesn’t enhance its worth. Understanding this distinction is fundamental for financial planning in real estate.

- Careful planning and strategic allocation of capital expenditures can lead to higher property values and increased cash flow. Leveraging CapEx to improve property amenities or energy efficiency can attract higher rents, reduce vacancy rates, and ultimately generate substantial returns on investment.

Suggested Posts

- Multifamily Operating Expenses: A Beginner’s Guide

- The Ultimate Guide To Conducting Effective Resident Surveys

- Apartment Turnover | A Landlord’s Comprehensive Guide

- Condos vs. Apartments | Your Guide To Choosing The Right One

- How To Set Up A Package Room In 2023?

Understanding Capital Expenditures In Real Estate

- Capital Expenditure, often referred to as a capital expense or CapEx, is the allocation of funds by a company for the purpose of acquiring, preserving, or expanding its fixed assets.

- These fixed assets represent non-current, illiquid, and long-term resources that are intended for utilization over a period exceeding one year.

- A prime category of such assets includes Property, Plant, and Equipment (PP&E), encompassing structures and machinery integral to the production process.

Understanding the Nature of Capital Expenditure

- In essence, capital expenditures denote investments made in these enduring assets, with what is known as a “useful life” surpassing one taxable year.

- According to the criteria set by the U.S. Internal Revenue Service (IRS), investments in assets with a useful life extending beyond a single year are subject to capitalization.

- Capitalizing a cost or investment entails treating it as an asset on the company’s balance sheet instead of recognizing it as an immediate expense.

- This capitalization approach involves the gradual allocation of the cost over the asset’s expected lifetime.

Practical Example of Capitalization

- To illustrate this concept with a practical example, consider a scenario where a company plans to invest $5,000 in a machine anticipated to be in use for five years.

- Rather than expending the entire $5,000 payment in the year of acquisition, the machine is treated as an asset.

- The cost is allocated over the machine’s anticipated five-year lifespan, equating to $1,000 per year for five years.

- The yearly allocation of this capitalized expenditure ($1,000 in this case) represents depreciation on the company’s financial statements.

- This process ensures a more accurate reflection of the asset’s value and its impact on the company’s financial performance over time.

How to Calculate Capital Expenditure in Real Estate – Formula and Components

Understanding how to calculate Capital Expenditures (CapEx) is vital for assessing a company’s financial health and investment in its future growth. Companies typically disclose CapEx in their cash flow statements. However, in cases where this information is unavailable, one can determine the CapEx for a specific accounting period using details from the company’s balance sheet and income statement.

CapEx Formula

The CapEx formula is a straightforward way to calculate a company’s capital expenditures. It involves a simple mathematical expression:

CapEx = PP&E(current) – PP&E (previous) + Depreciation (current)

Components of the Formula

The formula comprises three essential components:

PP&E (current)

This refers to the current value of the company’s Property, Plant, and Equipment (PP&E) as presented in its financial statements. ‘Current’ implies using the value from the accounting period you are interested in. For instance, if you’re calculating CapEx for 2022, you’d use the 2022 total value of PP&E from the balance sheet.

PP&E (previous)

The ‘previous’ PP&E represents the value of the company’s Property, Plant, and Equipment from the accounting period immediately preceding the one you’re calculating CapEx for. If you’re interested in CapEx for 2022, you’d use the 2021 total value of PP&E from the balance sheet.

Depreciation (current):

Depreciation or amortization for intangible fixed assets represents the annual amount of investment in fixed assets that is spread out over the asset’s expected lifetime. For example, if a company buys a $5,000 piece of equipment intended for five years of use and capitalizes the cost over that period, the annual depreciation would be $1,000.

Example Calculation

Let’s illustrate the formula with a practical example. Consider a company in the wireless headphone industry with various fixed assets. In 2021, the total value of these assets was $3 million, but in 2022, due to asset sales and changes in software licensing, the value reduced to $2.5 million. The company reported a total depreciation and amortization of $1 million in 2022.

Using the formula:

CapEx = $2.5 million – $3 million + $1 million

CapEx = $0.5 million or $500,000

Interpreting the Results

The calculated CapEx of $500,000 for 2022 indicates that the wireless headphone company invested this amount in capital expenditures during that year. Accountants use this information to monitor how a company is allocating resources to promote future growth and expansion.

Internally, financial teams analyze CapEx in the context of other financial metrics such as revenue, liabilities, and short-term assets. If a company consistently overspends on CapEx without corresponding revenue growth, budget adjustments may be necessary.

Externally, investors use annual CapEx figures to gauge a company’s commitment to future growth. However, they consider other factors, such as annual cash flows and net working capital, to obtain a comprehensive understanding of the company’s financial strategy.

Step 1: Start with the Cash Flow Statement

Begin by examining the cash flow statement of a company. The cash flow statement provides an overview of the company’s cash inflows and outflows. Look for the section related to “Investing Activities,” which includes transactions related to capital assets.

Step 2: Deduct Fixed Assets

Identify any purchases of fixed assets during the period. Fixed assets are items expected to provide benefits for more than one accounting period. Deduct these purchases from the total investment in the investing activities section of the cash flow statement. This step isolates the capital expenditures from other investment activities.

Step 3: Add the Difference to Depreciation

Add the difference between the fixed asset purchases (Step 2) and any disposals of fixed assets that occurred during the period. This adjustment is necessary to account for the net change in the company’s asset base. Also, add any capital lease payments and improvements to existing assets that increase their useful life. Finally, add any changes in accumulated depreciation for the period. This step ensures that the CapEx calculation accounts for both new investments and the maintenance of existing assets.

How to Calculate the Capital Budget for Reserves?

A capital budget for reserves is a plan that outlines how a company will allocate funds for capital expenditures. This budget takes into account the company’s financial goals, available resources, and the prioritization of projects. To create a capital budget for reserves, follow these steps:

- Identify and list potential capital projects: Begin by identifying and listing all potential capital projects that may require funding in the near future. This can include maintenance, expansion, or acquisition of assets.

- Estimate the costs: For each project, estimate the total capital expenditure required. This should include all associated costs such as equipment, labor, materials, and any indirect expenses.

- Prioritize projects: Determine which projects are most critical to the company’s strategic goals and financial stability. Prioritization helps ensure that the most important projects receive funding first.

- Assess available funds: Evaluate the company’s financial resources, taking into account cash reserves, available credit, and any external financing options.

- Allocate funds: Allocate funds to each project based on the prioritization and available resources. It’s essential to strike a balance between addressing immediate needs and investing in projects that will yield long-term benefits.

- Monitor and adjust: Continuously monitor the progress of capital projects and adjust the budget as necessary to accommodate unforeseen changes or new opportunities.

What Are Capital Expenditure Reserves?

- Capital expenditure reserves, also known as capital reserves, are funds set aside by a company to cover future capital expenditures.

- These reserves are typically created by retaining a portion of the company’s profits rather than distributing them as dividends to shareholders.

- Capital expenditure reserves serve as a financial safety net, ensuring that a company has the necessary funds to invest in capital assets without relying solely on external financing.

Capital Expenditures vs. Operating Expenditures

Nature of Expense

- Capital Expenditures: These are investments in long-term assets, such as property, machinery, and equipment, with the expectation of generating benefits over an extended period.

- Operating Expenditures: These are day-to-day expenses incurred in the normal course of business operations, such as salaries, rent, utilities, and office supplies.

Accounting Treatment

- Capital Expenditures: Capital expenditures are typically capitalized on the balance sheet and depreciated or amortized over their useful life.

- Operating Expenditures: Operating expenditures are expensed immediately on the income statement and do not impact the balance sheet.

Impact on Profit

- Capital Expenditures: They do not immediately reduce profits but can impact profitability over time due to depreciation or amortization.

- Operating Expenditures: They reduce profits in the period in which they are incurred.

Duration

- Capital Expenditures: Benefit the company over multiple accounting periods, as they are investments in long-term assets.

- Operating Expenditures: Provide immediate benefits but are consumed within the current accounting period.

What Is CapEx on the Cash Flow Statement?

- On the cash flow statement, CapEx appears as an outflow under the “Investing Activities” section.

- It reflects the cash spent on acquiring, maintaining, or improving capital assets during a specific accounting period.

- Understanding CapEx on the cash flow statement is essential for investors and analysts to assess a company’s commitment to long-term growth and asset management.

What Is CapEx on the Balance Sheet?

- CapEx does not directly appear on the balance sheet. Instead, the capital assets acquired through CapEx are recorded as assets on the balance sheet.

- These assets are typically listed under categories such as property, plant, and equipment.

- The balance sheet shows the historical cost of these assets, and their depreciation is recorded as an offsetting contra-asset account.

- Over time, as the assets depreciate, their value decreases on the balance sheet, reflecting their reduced worth.

Who Deals With Capital Expenditures?

- Capital Expenditures (CapEx) play a pivotal role in a company’s financial reporting, encompassing balance sheets, cash flow statements, and income statements.

- Accountants, as the architects of these financial statements, must possess a deep understanding of CapEx and its integration into a company’s overall financial landscape.

- Taxation also enters the picture, as accountants must grasp CapEx for tax compliance, given the stringent guidelines set by the IRS for reporting and claiming capitalized expenditures on tax documents.

- Beyond the accounting realm, CapEx holds significance for accountants, business owners, and a company’s financial team in the context of budgeting.

- The entire team needs to be well-versed in the allocation of funds for new Property, Plant, and Equipment (PP&E) and evaluating whether selling existing PP&E is a viable option to finance other business endeavors.

- A company’s financial team should also be adept at strategic employment of CapEx to yield long-term benefits and enhance the company’s financial position.

Why Are Capital Expenditures In Real Estate Important?

Capital expenditures (CapEx) are a critical aspect of financial management for businesses and organizations. These expenditures represent substantial investments in assets that have a long-term impact on a company’s operations. Capital expenditures are important for several reasons:

Strategic Decision Making

CapEx decisions involve large sums of money and often have long-term implications. They reflect a company’s strategic priorities and goals. Decisions about what to invest in (e.g., machinery, infrastructure, technology) can significantly affect the company’s future performance.

Asset Growth

Capital expenditures contribute to the expansion and growth of a company’s asset base. These assets, such as new facilities, equipment, or technology, enhance a company’s capabilities, competitiveness, and potential for revenue generation.

Operational Efficiency

Investing in capital assets can lead to improved operational efficiency. For example, purchasing newer, more efficient machinery can reduce production costs and increase productivity, which, in turn, enhances a company’s competitive advantage.

Tax Implications

Properly classifying and reporting capital expenditures can have tax benefits. Some CapEx may be eligible for depreciation or amortization, which can reduce a company’s taxable income, ultimately saving money.

Stakeholder Confidence

Shareholders, investors, and creditors are interested in a company’s CapEx because it reflects management’s commitment to long-term growth and success. Demonstrating a well-planned and executed capital expenditure strategy can enhance stakeholder confidence.

What Can Capital Expenditures In Real Estate Tell You?

Capital expenditures provide valuable insights into a company’s financial health and strategic direction. Here’s what they can tell you:

Financial Stability

Monitoring the level and consistency of CapEx can reveal a company’s financial stability. A consistent pattern of healthy CapEx indicates a company’s commitment to maintaining and growing its assets.

Growth Plans

A significant increase in CapEx may indicate that a company is planning to expand or upgrade its operations. This information can be useful for investors and analysts to gauge future revenue and earnings potential.

Competitive Advantage

By analyzing the specific assets being acquired or upgraded, you can gain insight into a company’s efforts to enhance its competitive advantage. For instance, investments in advanced technology might suggest a focus on innovation and market leadership.

Financial Management

Reviewing how capital expenditures are financed (e.g., through cash reserves, debt, or equity) can reveal a company’s financial management strategy. Highly leveraged CapEx decisions may raise concerns about debt levels.

How Do You Report Capital Expenditures In Real Estate?

Reporting capital expenditures accurately is essential for transparency and compliance. The financial reporting process typically includes the following steps:

Identify and Classify

Identify and classify expenditures as capital if they meet specific criteria, such as having a useful life of more than one year and providing future economic benefits. Regular maintenance costs should not be classified as capital expenditures.

Record in Financial Statements

Report capital expenditures in the financial statements, typically on the balance sheet or income statement. The choice of where to report them may depend on the accounting standards followed by the company (e.g., GAAP or IFRS).

Depreciation and Amortization

For assets with finite useful lives, calculate and record depreciation (for tangible assets) or amortization (for intangible assets) over time. Depreciation and amortization expense is reflected in the income statement, reducing the asset’s carrying value.

Compliance with Regulations

Ensure compliance with accounting standards and tax regulations when reporting capital expenditures. Non-compliance can lead to financial penalties and harm a company’s reputation.

Differentiating Between Capital Expenditures and Regular Maintenance

It’s crucial to differentiate between capital expenditures and regular maintenance expenses as this affects financial reporting and taxation. Here are some key distinctions:

Capital Expenditures

- Long-Term Impact: CapEx investments have a long-term impact on a company’s operations and usually benefit the organization for more than one year.

- Assets: Capital expenditures result in the acquisition or improvement of assets that are recorded on the balance sheet.

- Depreciation/Amortization: These assets are subject to depreciation (for tangible assets) or amortization (for intangible assets) over their useful lives.

- Strategic: CapEx is strategic and focused on improving or expanding the business.

Regular Maintenance

- Short-Term Impact: Maintenance expenses are incurred to keep existing assets in working condition and typically benefit the company in the short term.

- Expense: Maintenance costs are recorded as an expense in the income statement during the period incurred.

- No Depreciation/Amortization: Maintenance costs are not subject to depreciation or amortization because they do not create or improve assets.

- Operational: Maintenance is necessary for the regular, day-to-day operation of the business.

Differentiating Between Positive and Negative Capital Expenditures In Real Estate

Not all capital expenditures are created equal; they can be either positive or negative based on their impact on the business:

Positive Capital Expenditures

- Growth and Improvement: Positive CapEx investments are those that lead to increased revenue, improved efficiency, or enhanced competitive advantage.

- Long-Term Value: They have the potential to increase the long-term value of the company.

- Example: Investing in state-of-the-art manufacturing equipment that increases production capacity and efficiency, leading to higher profits.

Negative Capital Expenditures

- Deterioration: Negative CapEx investments reduce a company’s long-term value, often by not providing the expected benefits or by eroding existing value.

- Waste of Resources: They represent a misallocation of resources and can be detrimental to the company’s financial health.

- Example: A failed expansion project that ends up costing more than expected and does not generate the projected revenue.

Characteristics Of Capital Expenditures In Real Estate

- Long-Term Nature: Capital expenditures (CapEx) are characterized by their long-term and enduring impact on a business. These expenditures involve investments in assets expected to generate benefits over an extended period, typically exceeding one year. Examples include the acquisition of machinery, buildings, vehicles, and technology infrastructure.

- Enhancement of Productive Capacity: CapEx is incurred to improve or expand a company’s productive capacity. It enables a business to increase its output, efficiency, or quality, which can lead to increased revenues or cost savings over time.

- Non-Recurring: Capital expenditures are typically non-recurring expenses. They are distinct from operating expenses (OpEx), which are incurred in the day-to-day operations of a business. CapEx investments are made infrequently and often in pursuit of strategic goals.

- Significant Financial Outlay: Capital expenditures usually involve a substantial financial outlay. These investments can significantly affect a company’s financial statements, and as such, they require careful planning and consideration.

- Depreciation: To account for the cost of these assets over their useful life, CapEx items are typically depreciated. Depreciation is the process of allocating the initial cost of the asset as an expense over several years, reflecting the asset’s diminishing value due to wear and tear or obsolescence.

Depreciation

- Systematic Allocation of Costs: Depreciation is the method by which the cost of a capital asset is systematically allocated as an expense over its estimated useful life. This allocation allows a business to match the cost of the asset with the revenue it generates, resulting in a more accurate representation of the company’s financial performance.

- Types of Depreciation: There are several methods for calculating depreciation, including straight-line depreciation, declining balance depreciation, and units-of-production depreciation. Each method offers a different way to spread the cost of the asset over time, allowing businesses to choose the one that best matches their specific needs.

- Impact on Financial Statements: Depreciation reduces the book value of an asset on the balance sheet and increases the expenses on the income statement. This can have a significant impact on a company’s reported profitability and financial position, as well as its tax liability.

- Asset Replacement or Upgrade: Depreciation helps in assessing when an asset has reached the end of its useful life and needs to be replaced or upgraded. This is crucial for maintaining the company’s competitiveness and operational efficiency.

Difficulty in Measuring Depreciation

- Subjectivity: The estimation of an asset’s useful life and residual value is often subjective. Different accounting standards and practices can lead to variations in the calculation of depreciation, which can impact financial statements and comparisons between companies.

- Changing Asset Values: In rapidly evolving industries, assets can become obsolete more quickly than anticipated. Determining the appropriate useful life and salvage value becomes challenging, as these may change over time.

- External Factors: Factors like technological advancements, market conditions, and regulatory changes can impact asset values and useful lives, making it difficult to predict how an asset will depreciate accurately.

- Financial Reporting Complexity: Accounting standards (e.g., IFRS and GAAP) have specific guidelines for depreciation, but their application can be complex, requiring significant expertise. This complexity can lead to variations in depreciation practices among companies.

Connection to Long-Term Investments

Capital expenditures are intrinsically tied to long-term investments. Long-term investments are financial assets that are held for a significant period, typically exceeding one year. Capital expenditures involve the acquisition or improvement of tangible assets like property, plant, and equipment, which are considered long-term investments. Here’s how they are interconnected:

- Capital Growth: Capital expenditures are a means for a company to invest in its growth and development. These investments often lead to the expansion of productive capacity, which is vital for long-term sustainability and competitiveness.

- Asset Appreciation: Long-term investments can include securities like stocks and bonds, which can appreciate in value over time. Similarly, the capital assets acquired through CapEx can appreciate in value, especially if they are well-maintained or if their utility is enhanced through upgrades or expansions.

- Financial Impact: Both capital expenditures and long-term investments can significantly impact a company’s financial statements. They can affect the balance sheet (assets and liabilities) and income statement (revenues and expenses) and influence the overall financial health of the organization.

- Risk and Reward: Long-term investments, whether in financial instruments or tangible assets, involve varying degrees of risk and potential reward. The assessment of these factors is essential for strategic decision-making and long-term financial planning.

Types of Capital Expenditures In Real Estate

Capital expenditures can be categorized in various ways, including:

Maintenance vs. Capital Improvements

Maintenance Expenditures

These expenditures are costs incurred to keep an asset in its existing condition and operational. They are necessary for preserving the asset’s current utility and are considered a regular cost of doing business. Maintenance expenses are typically deductible in the year they occur.

Examples

- Regular cleaning and janitorial services for a commercial building.

- Replacing worn-out light bulbs in a hotel.

- Routine oil changes and filter replacements for a fleet of vehicles.

Capital Improvements

Capital improvements are expenditures that enhance the value or extend the useful life of an asset. They go beyond mere maintenance and lead to a significant upgrade or betterment of the asset. Capital improvements are typically capitalized and depreciated over time.

Examples

- Installing energy-efficient windows in a commercial building.

- Upgrading a factory’s production machinery to improve efficiency.

- Expanding the square footage of a retail store through a construction project.

Exterior vs. Interior Expenditures

Exterior Expenditures

These expenditures refer to investments made in the outer components or structure of a property or asset. They can include repairs, improvements, or additions to the building’s exterior, such as roofs, walls, or landscaping.

Interior Expenditures

Interior expenditures pertain to investments made within the confines of a property or asset. These typically involve modifications, upgrades, or repairs to the interior components like walls, floors, HVAC systems, and fixtures.

Common Capital Expenditures in Real Estate

- Roof Repairs and Replacements: Roofs are critical to a building’s integrity and functionality. Spending on roof repairs or replacements is considered a capital expenditure because it significantly extends the life of the property and protects it from structural damage.

- HVAC System Upgrades: Upgrading heating, ventilation, and air conditioning (HVAC) systems with energy-efficient models not only improves indoor comfort but also reduces operational costs. This constitutes a capital improvement, as it enhances the asset’s value and long-term functionality.

- Structural Repairs: Major structural repairs, such as fixing a cracked foundation or reinforcing load-bearing walls, fall under capital expenditures. They are essential for maintaining the integrity of the property.

- Plumbing and Electrical Improvements: Replacing outdated plumbing or electrical systems with more efficient and modern ones qualifies as capital improvements. These enhancements contribute to the property’s long-term value and performance.

- Flooring and Painting: Replacing old flooring or repainting interior surfaces can be categorized as interior capital improvements. They enhance the aesthetic appeal and overall condition of the property, extending its life and marketability.

- Landscaping and Outdoor Renovations: Investments in outdoor spaces, such as landscaping, adding amenities like swimming pools, or constructing walkways, can be considered capital expenditures. They enhance the curb appeal and overall attractiveness of the property, potentially increasing its value.

Importance of Distinguishing Capital Expenditures In Real Estate

Impact on Taxes

Depreciation vs. Deductibility

- Distinguishing between capital expenditures and operational expenses is crucial because it directly impacts your business’s tax liabilities.

- Capital expenditures are investments in assets that provide benefits over multiple years, while operational expenses are costs incurred to maintain the day-to-day operations of a business.

- One significant tax implication is related to depreciation.

- Capital expenditures can often be depreciated over time, allowing businesses to deduct a portion of the expense each year.

- This depreciation can be a substantial tax benefit because it reduces the taxable income, resulting in lower tax liabilities.

- In contrast, operational expenses are typically fully deductible in the year they are incurred.

Tax Implications of Capital Expenditures in Real Estate

- Properly categorizing capital expenditures also influences the timing of tax deductions.

- When you correctly identify capital investments, you spread the tax benefits over the useful life of the asset through depreciation deductions.

- This can lead to significant long-term tax savings.

- Conversely, if you incorrectly categorize capital expenditures as operational expenses, you may lose out on valuable depreciation deductions, leading to higher immediate tax liabilities.

- Additionally, some governments offer tax incentives or credits for certain types of capital investments, making it crucial to distinguish between the two categories to take advantage of these benefits.

Effect on Property Value

How Capital Improvements Can Enhance Property Value

- Distinguishing between capital expenditures and operational expenses plays a vital role in determining the overall value of properties, especially in the context of real estate.

- Capital improvements, such as renovating a building or adding modern amenities, can significantly enhance the property’s value.

- These improvements make the property more appealing to potential buyers or tenants, allowing for higher rental or resale prices.

- Over time, these capital investments can lead to substantial gains in property value.

- Therefore, accurately accounting for these capital expenditures is crucial for property owners looking to maximize their return on investment.

Lease Agreements

Implications for Property Owners and Tenants

- Lease agreements in commercial real estate often hinge on the distinction between capital and operational expenses.

- Property owners may pass on some capital expenses to tenants through Common Area Maintenance (CAM) charges.

- Accurate categorization of these expenses is essential for ensuring that tenants are paying their fair share.

- If capital expenses are misclassified as operational expenses, it can lead to disputes between property owners and tenants.

- Property owners may also be able to claim tax deductions for capital expenses passed on to tenants.

- Therefore, understanding the difference between these categories is crucial for both parties to maintain a transparent and fair lease agreement.

Long-term Asset Management

Sustaining and Increasing Asset Value

- Properly distinguishing capital expenditures from operational expenses is fundamental to long-term asset management.

- Capital investments in assets such as machinery, buildings, or infrastructure are made with the expectation that they will generate benefits over many years.

- Effective asset management involves ensuring that these investments continue to provide value and do not become burdensome.

- By categorizing capital expenditures correctly, you can plan for the ongoing maintenance and replacement of these assets.

- This helps in sustaining their value over time and ensures that they remain productive and operational.

- Misclassifying capital expenses as operational can lead to underinvestment in asset maintenance, reducing their value over time and potentially resulting in costly repairs or replacements.

Budgeting for Capital Expenditures In Real Estate

Managing capital expenditures (CapEx) is a crucial aspect of financial planning for any organization. Capital expenditures involve significant investments in assets, infrastructure, or projects that can generate long-term value. Proper budgeting for these expenditures is essential to ensure financial stability and sustainable growth. In this detailed explanation, we will explore the two key aspects of budgeting for capital expenditures: Creating a Reserve Fund and Capital Expenditure Planning.

Creating a Reserve Fund

Purpose and Importance

A reserve fund for capital expenditures is a dedicated pool of money set aside to cover large-scale investments in assets or projects. This fund serves several essential purposes:

- Risk Mitigation: It helps organizations prepare for unexpected maintenance or replacement of critical assets, reducing the financial burden associated with sudden capital expenditures.

- Stability: By allocating funds over time, organizations can maintain financial stability, ensuring that they have the means to undertake important projects without straining their budgets.

- Strategic Planning: Reserve funds enable strategic planning for the replacement or expansion of assets, ensuring they remain up-to-date and meet evolving operational requirements.

- Credibility: Having a well-funded reserve for capital expenditures enhances an organization’s financial credibility in the eyes of investors, creditors, and stakeholders.

- Compliance: In some industries, maintaining a reserve fund for capital expenditures may be a regulatory requirement.

Methods for Funding

Reserve funds for capital expenditures can be funded through various methods:

- Allocated Annual Budget: Organizations can allocate a specific percentage of their annual budget to the reserve fund. This method ensures consistent contributions over time.

- Surplus Funds: Windfalls or surplus funds generated in profitable years can be channeled into the reserve fund, bolstering it for future needs.

- Loans or Bonds: Some organizations may choose to fund their reserves through borrowing, either by taking out loans or issuing bonds. However, this method may involve interest payments, impacting overall costs.

- Special Assessments or Fees: In certain cases, organizations may levy special assessments or fees on members, customers, or stakeholders to build the reserve fund more rapidly.

- Investment Earnings: Organizations can invest the reserve fund in low-risk, interest-bearing assets to generate additional income, further growing the fund.

Capital Expenditure Planning

Developing a Comprehensive Plan

Effective capital expenditure planning is essential to ensure that the organization’s funds are allocated strategically. This process involves several steps:

- Asset Assessment: Begin by conducting a thorough assessment of all assets and infrastructure. Identify items that require maintenance, replacement, or upgrades.

- Cost Estimation: For each identified expenditure, estimate the cost involved. This should include not only the direct purchase or construction costs but also ongoing operational and maintenance expenses.

- Lifecycle Analysis: Consider the expected lifecycle of assets and projects. Determine when they will require significant investment or replacement.

- Prioritization: Prioritize capital expenditures based on factors such as safety, regulatory compliance, operational efficiency, revenue generation potential, and overall strategic goals.

- Funding Sources: Determine how each expenditure will be funded, whether from the reserve fund, loans, or other sources.

Prioritizing Expenditures

Prioritizing capital expenditures is a critical aspect of the planning process:

- Critical Infrastructure: Start with essential assets, infrastructure, or projects that are vital to the organization’s core operations or safety. These should be the top priority.

- Strategic Alignment: Align capital expenditures with the organization’s strategic goals. Investments that contribute to long-term growth and competitiveness should be prioritized.

- Regulatory Compliance: Address expenditures necessary for regulatory compliance promptly to avoid fines or legal issues.

- Cost-Benefit Analysis: Conduct a cost-benefit analysis to determine which projects will provide the most significant return on investment over time.

- Timing: Consider the timing of expenditures to ensure that they do not disrupt ongoing operations or incur higher costs due to delays.

Estimating Capital Expenditures In Real Estate

Capital expenditure costs are a critical component of financial planning for businesses and individuals alike, especially when it comes to real estate investments. Estimating these costs involves a comprehensive analysis of the expenses associated with acquiring, maintaining, and upgrading assets. In this section, we will delve into the key aspects of estimating capital expenditure costs, from cost analysis and budgeting to the various factors that affect these costs.

Cost Analysis and Budgeting

Detailed Cost Breakdown

Estimating capital expenditure costs begins with a meticulous breakdown of all potential expenses. This involves a comprehensive analysis of each component that contributes to the overall cost. Some of the primary categories to consider include:

- Purchase Costs: This includes the initial purchase price of the property, real estate agent fees, legal fees, and any other transaction-related expenses.

- Maintenance and Repairs: These ongoing expenses are essential for ensuring the property’s functionality and value. Maintenance may include routine tasks such as landscaping, cleaning, and minor repairs, while repairs cover more significant expenses like fixing plumbing or electrical issues.

- Renovations and Upgrades: Over time, renovations and upgrades may be required to keep the property competitive in the market. These can range from minor cosmetic improvements to major structural changes.

- Taxes and Insurance: Property taxes and insurance premiums are recurring expenses that must be accounted for in the budget.

- Financing Costs: If you are borrowing money to make the capital expenditure, interest payments and other financing costs should be considered.

- Contingency Fund: It is prudent to set aside a contingency fund for unforeseen expenses or emergencies.

- Depreciation: Accounting for asset depreciation is essential, especially for tax purposes.

- Environmental Compliance: Some capital expenditures may be subject to environmental regulations, necessitating costs for compliance.

- Soft Costs: Legal fees, permits, and other associated costs that may not be directly tied to construction but are essential for the project.

Estimating Future Expenses

- A crucial part of capital expenditure cost estimation is forecasting future expenses.

- To do this, you need to consider the property’s age, condition, and the expected lifespan of its various components (e.g., roof, HVAC systems, plumbing).

- A maintenance schedule should be developed based on industry standards and expert opinions.

- By projecting when major repairs or replacements will be needed, you can plan and budget for these expenses accordingly.

- Utilizing a computerized maintenance management system (CMMS) can help streamline this process by tracking the property’s condition and generating maintenance schedules.

Factors Affecting Costs

Location and Market Conditions

The location of the property and current market conditions have a significant impact on capital expenditure costs. Here are key points to consider:

- Regional Variations: Costs for labor, materials, and permits can vary widely from one geographic location to another. Consider the local cost of living and economic conditions.

- Market Trends: The demand for certain types of properties and features can affect the costs of renovations and upgrades. Staying informed about market trends can help you anticipate these expenses.

- Regulatory Environment: Local zoning and building codes can impact your project’s costs, as different areas may have specific requirements and regulations.

Age and Condition of the Property

The age and condition of the property are central factors in determining capital expenditure costs. The following aspects should be carefully assessed:

- Building Inspection: Conduct a thorough inspection of the property to identify existing issues and estimate repair or renovation costs.

- Property History: Review maintenance and repair records, if available, to assess the property’s maintenance history.

- Useful Life Assessment: Understand the expected lifespan of major components and plan for their replacement accordingly.

- Building Type: The type of property, such as residential, commercial, or industrial, can influence the nature and cost of capital expenditures.

Contractor Selection and Negotiation

The choice of contractors and effective negotiation can have a significant impact on capital expenditure costs. Here’s what you need to consider:

- Multiple Bids: Solicit bids from multiple contractors to compare pricing and select the most competitive offer.

- Contractor Reputation: Consider the reputation and track record of contractors in terms of quality and reliability.

- Contract Terms: Negotiate clear and comprehensive contracts that outline scope, timelines, costs, and penalties for delays or overruns.

- Value Engineering: Discuss potential cost-saving alternatives with the contractor without compromising quality or safety.

Funding Capital Expenditures

Financing Options

Cash Reserves

- Utilizing cash reserves is one of the most straightforward methods for funding capital expenditures.

- Businesses use their accumulated profits or retained earnings to cover the costs of CapEx.

- This method is advantageous as it does not incur interest or debt, preserving the company’s financial independence.

- It is particularly useful for smaller businesses with substantial cash reserves.

Loans and Mortgages

- Securing loans or mortgages from financial institutions is a common method for funding capital expenditures.

- Loans can be secured against assets, such as real estate or equipment, or unsecured, based on the company’s creditworthiness.

- Mortgages are typically used to fund real estate-related CapEx.

- This method provides immediate access to funds and allows for spreading the payments over time, reducing the initial financial strain.

Refinancing

- Refinancing involves restructuring existing debts to free up capital for capital expenditures.

- It is a strategic approach to reduce the interest rate or extend the repayment period of existing loans, thus freeing up cash for investments.

- This method is advantageous for companies with high-interest debt or those seeking to optimize their financial structure.

Equity Partners

- Bringing in equity partners involves selling a portion of the business to external investors.

- This method can provide a significant injection of capital for CapEx.

- Equity partners can be individuals, venture capitalists, or private equity firms.

- It is a common choice for startups and businesses with high growth potential.

Risk and Benefits of Funding Options

Cash Reserves

Pros

- Preserves financial autonomy and avoids incurring interest or debt.

- Ideal for smaller companies with adequate cash reserves.

Cons

- May deplete cash reserves, leaving the company with fewer resources for unforeseen emergencies.

- Reduces liquidity and the ability to invest in other opportunities.

Loans and Mortgages

Pros

- Immediate access to funds for CapEx needs.

- Allows for spreading payments over time, reducing the initial financial burden.

Cons

- Interest payments can be a financial burden, particularly for high-value loans.

- Loans require collateral, which could be at risk in case of default.

Refinancing

Pros

- Lowers interest rates, reducing the overall cost of capital.

- Provides an opportunity to free up funds for investments without taking on new debt.

Cons

- May require fees and penalties for early loan repayment or restructuring.

- Involves negotiations with lenders, which can be time-consuming.

Equity Partners

Pros

- Infuses substantial capital without incurring debt.

- Provides access to expertise and resources of equity partners.

Cons

- Dilutes ownership and control, as equity partners may have a say in business decisions.

- Profit-sharing with partners reduces the company’s future earnings potential.

Executing Capital Expenditure Projects

This section covers the key aspects of executing CapEx projects, including project management, legal and regulatory compliance, quality assurance, cost control, and project completion and sign-off.

Project Management

Planning and Scheduling

- Planning is the initial and fundamental step in executing a CapEx project. It involves defining project goals, objectives, and scope.

- Scheduling sets a timeline for project activities, ensuring that tasks are completed in a logical sequence and within specified timeframes.

- Effective planning and scheduling help allocate resources efficiently, minimize delays, and ensure the project stays on track.

Hiring Contractors and Professionals

- For many CapEx projects, it is essential to engage contractors, architects, engineers, and other professionals with the necessary expertise.

- The selection of competent contractors and professionals is crucial for the project’s success.

- Contractors should be chosen based on their track record, reputation, and ability to meet project requirements.

Legal and Regulatory Compliance

Permits and Licenses

- Obtaining the required permits and licenses is vital to ensure the project operates within the bounds of the law.

- Compliance with local, state, and federal regulations is necessary to avoid legal complications and potential fines.

- The responsible party must diligently identify and secure all necessary permits before project commencement.

Environmental Regulations

- Many CapEx projects may have environmental implications, such as land development or construction near sensitive areas.

- Compliance with environmental regulations is critical to mitigate negative impacts and prevent legal action.

- Environmental assessments and adherence to mitigation measures are essential.

Quality Assurance

Ensuring the Work Meets the Intended Standard

- Quality assurance involves consistent inspection, testing, and verification of the work to ensure it aligns with project specifications and industry standards.

- Implementing a quality control plan and employing skilled inspectors are crucial.

- Adherence to quality standards not only meets the project’s goals but also enhances the durability and longevity of the asset.

Cost Control

Monitoring Expenses During the Project

- Controlling costs during the project is essential to avoid budget overruns.

- Establishing a robust cost control system involves regular financial tracking, monitoring, and reporting.

- It is critical to identify variances from the budget and address them promptly to avoid financial setbacks.

Project Completion and Sign-Off

- Project completion marks the final phase of the CapEx project, where all elements are completed, inspected, and ready for use.

- Sign-off involves a comprehensive review of the project’s objectives, ensuring they have been met.

- This phase also involves preparing as-built documentation, training staff, and transitioning to operational use.

Record-Keeping and Documentation

Effective record-keeping and documentation are essential aspects of managing any business or project, whether it’s a small startup, a large corporation, or an individual endeavor. Keeping comprehensive and organized records is crucial for various reasons, including maintaining transparency, ensuring compliance with legal and regulatory requirements, managing finances, and facilitating decision-making processes. This detailed explanation will delve into the importance of documentation, organizing records, and the tax and accounting considerations associated with record-keeping.

Importance of Documentation

- Legal Compliance: Proper documentation is often a legal requirement. For businesses, it helps to fulfill regulatory obligations. For individuals, it’s essential for personal tax compliance.

- Transparency: Documentation creates a transparent record of financial transactions, project progress, and other critical information. This transparency is crucial for stakeholders, such as investors, partners, and government agencies.

- Dispute Resolution: Well-maintained records can serve as evidence in case of disputes or legal issues. This can include contract disputes, tax audits, or employee conflicts.

- Decision-Making: Access to well-organized records facilitates data-driven decision-making. For businesses, this can mean strategic choices, and for individuals, it can aid in financial planning.

- Risk Management: Proper documentation helps in identifying and mitigating risks. It enables you to assess where you stand financially and what potential liabilities you might have.

Organizing Records

Invoices and Receipts

- Digital or Physical Copies: Store both digital and physical copies of invoices and receipts. Digital storage is efficient and eco-friendly, while physical copies are necessary for certain legal compliance and backup.

- Categorization: Create a system for categorizing invoices and receipts. For businesses, this might include categorizing them by expense type or vendor. For individuals, it might be based on tax deductibility.

- Timeliness: Organize invoices and receipts as you receive them. Waiting until the last minute can lead to confusion and lost documentation.

Project Contracts and Agreements

- Central Repository: Keep all project-related contracts and agreements in a centralized location. This can be a physical folder or a dedicated digital folder.

- Version Control: Maintain version control for contracts. Clearly label and date revisions to ensure you are working with the most up-to-date agreement.

- Backups: Back up project contracts in secure locations. This provides a safety net in case of data loss.

Tax and Accounting Considerations

Tracking Depreciation

- Asset Documentation: Maintain records of all depreciable assets, including purchase price, date of acquisition, and estimated useful life.

- Depreciation Methods: Understand and apply the appropriate depreciation method (e.g., straight-line, declining balance) as per tax regulations and accounting standards.

- Consistency: Be consistent in your depreciation calculations to maintain accuracy and compliance.

Reporting to Tax Authorities

- Tax Deadlines: Familiarize yourself with tax deadlines for your jurisdiction. Timely filing is crucial to avoid penalties.

- Accurate Data: Ensure that the information you report is accurate and complete. Inaccurate reporting can lead to audits and fines.

- Documentation Retention: Be aware of how long you need to retain tax records. In the United States, for example, the IRS recommends retaining tax records for at least three years.

Issues with Capital Expenditures In Real Estate

Risk and Unpredictability

Capital expenditures are fraught with inherent risks and uncertainties that can affect a business’s financial health and strategic decision-making. Key aspects of this issue include:

- Economic and Market Factors: CapEx decisions often hinge on predictions of future demand and economic conditions. For instance, investing in new manufacturing equipment assumes a stable market for the product. However, market dynamics can change rapidly, and predicting these changes accurately can be challenging.

- Technology and Obsolescence: Technological advancements can make equipment or facilities obsolete sooner than expected. If a company invests heavily in outdated technology, they may suffer from competitive disadvantages and loss of market share.

- Regulatory Changes: Legislative changes can impact the feasibility of certain capital projects. Environmental regulations, for instance, can require costly retrofits or render a previously profitable project unviable.

- Project Delays: Delays in capital projects can be costly due to factors like weather, supply chain disruptions, or unforeseen construction issues. These delays can lead to budget overruns and missed revenue opportunities.

- Currency Exchange Rates: For international companies, fluctuating currency exchange rates can pose significant risk, affecting the cost of imported equipment and the revenue generated from exported goods.

High Initial Costs

One of the primary issues with capital expenditures is the substantial upfront costs involved, which can strain a company’s finances and pose significant challenges:

- Liquidity and Cash Flow: Large capital investments tie up significant financial resources that could otherwise be used for other purposes, like research and development or debt reduction. This can lead to cash flow constraints and hinder a company’s ability to seize unexpected opportunities.

- Borrowing Costs: If a business needs to secure financing to fund a capital project, they may incur interest expenses, further impacting profitability.

- Opportunity Cost: Funds used for CapEx projects have an opportunity cost – the potential returns the money could have generated if invested elsewhere. Businesses must weigh the returns from the capital project against these alternative investments.

Irreversibility

Another critical issue is the irreversibility of capital expenditures. Once the investment is made, it is typically challenging to recoup the capital if the project does not yield the expected returns:

- Sunk Costs: Capital expenditures often result in sunk costs, meaning the funds are invested and cannot be recovered. If the project fails or underperforms, the business is left with these unrecoverable costs.

- Strategic Commitment: Large capital investments commit a business to a specific strategic direction. If market conditions or internal goals change, the company may find itself locked into a less desirable path, which could be detrimental to long-term success.

- Depreciation and Salvage Value: As assets age, they depreciate in value, and their salvage value diminishes. This impacts the company’s ability to recoup initial costs if the assets are sold or repurposed.

Tips For Planning And Budgeting For Capital Expenditures In Real Estate

Planning and budgeting for capital expenditures (CapEx) is a critical aspect of financial management for any business or organization. Proper planning and budgeting for CapEx can have a significant impact on an organization’s financial health, growth, and competitiveness. Here are some detailed and elaborate tips to help you effectively plan and budget for CapEx:

Understand the Strategic Objectives

Before you begin budgeting for CapEx, it’s crucial to align your capital investment plans with your organization’s strategic objectives. Consider where you want your business to be in the long term, and identify the projects or assets needed to achieve those goals.

Conduct a Thorough Assessment

Assess the current state of your assets and infrastructure. Evaluate their condition, capacity, and performance. This assessment will help you identify areas that require investment and prioritize them based on urgency and impact.

Create a Capital Expenditure Committee

Establish a committee or team responsible for reviewing, approving, and overseeing CapEx projects. This group should consist of key decision-makers and experts in finance, operations, and the relevant departments to ensure well-informed decisions.

Develop a Capital Expenditure Policy

Create a policy that outlines the criteria for approving CapEx projects. This should include financial thresholds, risk assessment, and the expected return on investment (ROI). Having a clear policy streamlines the decision-making process.

Prioritize CapEx Projects

After assessing your needs, prioritize projects based on their strategic alignment, potential ROI, and urgency. Consider conducting a cost-benefit analysis for each project to identify the most promising opportunities.

Estimate Costs Accurately

Work with experts, contractors, or consultants to obtain accurate cost estimates for each project. Be sure to account for all direct and indirect costs, including equipment, labor, materials, permits, and ongoing maintenance.

Develop a Multi-Year CapEx Plan

Avoid short-term thinking by creating a multi-year CapEx plan. This plan should outline the timing and funding requirements for each project over the planning horizon, typically 3-5 years. It helps in spreading the financial burden and maintaining financial stability.

Consider Financing Options

Determine how you will finance CapEx projects. Options may include using cash reserves, taking out loans, or issuing bonds. Assess the cost of financing and how it impacts the overall ROI of each project.

Contingency Planning

Include a contingency budget for unexpected cost overruns or unforeseen issues during project implementation. A common practice is to allocate around 10-20% of the total project cost for contingencies.

Monitor and Review Regularly

CapEx budgets are not set in stone. Continuously monitor the progress of ongoing projects and review the overall budget. Adjustments may be necessary due to changes in market conditions, technology advancements, or shifts in business strategy.

Track Performance and ROI

You must track a project’s performance and ROI on completion. Compare the actual results with the initial projections to assess the success of your CapEx investments. This data will inform future decisions.

Maintain Records and Documentation

Keep detailed records of all CapEx transactions, approvals, and project-related documentation. This is crucial for accountability, auditing, and future reference.

Training and Education

Ensure that key personnel involved in CapEx planning and budgeting are well-versed in financial analysis and investment appraisal techniques. This knowledge will help them make informed decisions.

Regularly Communicate and Report

Keep stakeholders informed about the progress of CapEx projects. Provide regular reports to your management team and board of directors to maintain transparency and gain support for ongoing investments.

Adapt to Market Conditions

Be flexible in your approach. Economic conditions, industry trends, and the competitive landscape can change. Be prepared to adjust your CapEx plan accordingly.

Why Is PropTech A Great Capital Expenditures In Real Estate?

Proptech, short for property technology, has emerged as a powerful tool in the real estate industry, offering a wide range of benefits. It is indeed a great capital expenditure (CapEx) for property owners and developers for several reasons, including its ability to improve and enhance the tenant experience, increase the value of your property, and lower your building’s daily operating costs. Let’s delve into each of these aspects in a detailed and elaborate manner:

Improves and Enhances Tenant Experience

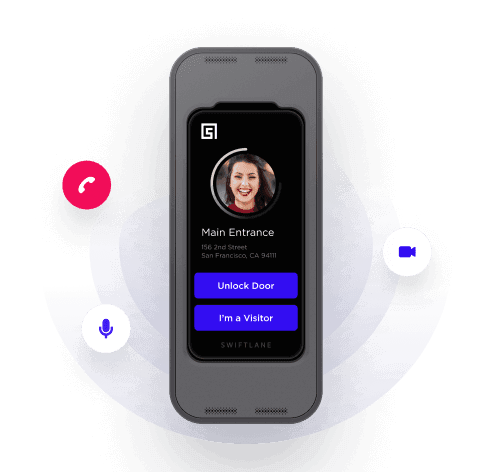

- Smart Building Management: Proptech allows property owners to implement advanced building management systems. You can integrate smart technologies like IoT sensors, energy-efficient lighting, and automated HVAC systems to create more comfortable and efficient living and working spaces. For example, IoT sensors can adjust lighting and temperature based on occupancy, enhancing the tenant’s comfort and reducing energy consumption.

- Security and Access Control: Proptech can include modern access control systems with features like biometric authentication, keyless entry, and remote access monitoring. This enhances the security of the property, making tenants feel safer, which is especially crucial in multi-unit residential buildings and commercial spaces.

- Communication and Engagement: Proptech platforms often offer communication channels that facilitate interaction between property management and tenants. This can include apps for reporting maintenance issues, accessing important documents, or even organizing community events. Such communication tools create a sense of community and responsiveness, thus enhancing the tenant experience.

- Data Analytics and Personalization: Proptech can collect and analyze data on tenant behavior and preferences. Property owners can use this data to tailor services and amenities to the specific needs of their tenants, making their experience more personalized and enjoyable.

Increases the Value of Your Property

- Higher Rent and Occupancy Rates: Properties equipped with proptech features, such as smart home automation and energy-efficient systems, can command higher rent and occupancy rates. Tenants are often willing to pay more for the added convenience and reduced utility costs provided by these technologies.

- Long-Term Investment: Proptech enhances the long-term value of your property by making it more attractive to potential buyers and investors. Properties with advanced technology are seen as more future-proof, which can increase their desirability and value in the real estate market.

- Sustainability and Green Building Certification: Proptech often includes energy-efficient and sustainability features. These not only reduce operating costs but also make the property eligible for green building certifications like LEED or BREEAM. Such certifications can significantly boost the property’s value due to the growing demand for environmentally responsible real estate.

Lowers Your Building’s Daily Operating Costs

- Energy Efficiency: Proptech allows for better control and optimization of energy usage. Smart lighting and HVAC systems can adjust based on occupancy and outdoor conditions, leading to substantial energy savings. These technologies also enable the tracking and analysis of energy usage, helping property owners identify and rectify inefficiencies.

- Predictive Maintenance: Proptech often includes predictive maintenance solutions that use data and AI to identify and address maintenance issues before they become major problems. This not only prolongs the life of building systems but also reduces the operational costs associated with emergency repairs and downtime.

- Cost-Effective Building Management: Integrated proptech platforms can streamline property management tasks, from tenant communication to financial tracking and maintenance scheduling. This efficiency can reduce labor and administrative costs, allowing property owners to allocate resources more effectively.

- Risk Mitigation: Proptech often includes features like building security and surveillance systems that can help mitigate risks like break-ins, fires, and other incidents that could lead to costly repairs and insurance claims.

6 Smart Steps For Understanding Capital Expenditures In Real Estate

Creating a well-structured Capital Expenditure (CapEx) budget is crucial for business owners to ensure their long-term success and financial stability. This budget is essential for strategic planning, as it determines how your business invests in and manages its long-term assets. Here are six smart steps for business owners to effectively manage their CapEx budgets:

Decide what assets to include in your CapEx budget by focusing on long-term goals

The first step in creating a successful CapEx budget is to identify the assets that align with your long-term business objectives. Ask yourself questions such as:

- What assets are essential for our growth and profitability over the next several years?

- How will these assets contribute to achieving our strategic goals?

- Are there any regulatory requirements or industry standards driving the need for specific assets?

For instance, if you’re running a manufacturing company, investing in advanced machinery may be critical for improving production efficiency and reducing costs, leading to long-term growth.

Justify each item with specific metrics

To make informed decisions, justify each asset you plan to include in your CapEx budget with specific metrics. Consider:

- ROI (Return on Investment): Calculate the expected ROI for each asset. This metric will help you determine the potential financial benefits of your investments.

- Payback period: Evaluate how long it will take to recoup the initial investment for each asset.

- NPV (Net Present Value): Assess the current value of future cash flows generated by each asset, adjusted for the time value of money.

Having concrete metrics will not only help you prioritize assets but also provide a clear rationale for their inclusion.

Include all associated costs and benefits

When building your CapEx budget, it’s essential to consider not only the initial acquisition cost but also all associated costs and benefits. This includes ongoing maintenance, training, operational costs, and any expected revenue enhancements. For example, if you’re investing in a new software system, factor in not only the software license but also employee training and potential productivity gains.

Go back to the principles of corporate finance

Adhering to the fundamental principles of corporate finance is vital when creating your CapEx budget:

- Risk assessment: Assess the risks associated with each asset. Understand the potential pitfalls and how they can impact your overall financial health.

- Cost of capital: Consider the cost of obtaining the funds for your investments, whether through debt or equity. Your investments should ideally yield returns higher than your cost of capital.

- Opportunity cost: Evaluate alternative uses of capital. If you invest in one asset, understand what other opportunities you are forgoing.

By considering these principles, you can make more informed decisions about where to allocate your resources.

Analyze alternatives

Before finalizing your CapEx budget, explore alternative options. This might involve comparing different vendors, asset models, or even different types of investments altogether. A thorough analysis can reveal more cost-effective solutions or opportunities for higher returns.

Measure success after the fact

Once you’ve implemented the assets included in your CapEx budget, it’s critical to measure and evaluate their actual performance. You must compare metrics such as actual ROI, payback periods, and NPV to your initial projections. If there are discrepancies, analyze the reasons behind them and adjust your future budgets accordingly.

Let’s Wrap Up

In summary, our exploration of capital expenditures in real estate has highlighted the pivotal role they play in property management and value enhancement. We’ve covered the basics, including the distinction between capital and operating expenses, the categories of capital investments, and their impact on property valuation.

Furthermore, we emphasized the significance of a well-structured capital expenditure plan and the financing options available. We also touched on the importance of staying compliant with tax and legal regulations and adapting to the evolving landscape of technology and sustainability.

In the ever-changing world of real estate, understanding capital expenditures is fundamental to successful property ownership and investment. You are now better prepared to make informed decisions, maximize property value, and adapt to industry trends.

As you navigate the dynamic world of capital investments in real estate, keep in mind that your wisdom lies not only in the allocation of capital but in your profound understanding of this ever-evolving field. This guide is your trusted companion, helping you make strategic decisions and succeed in the exciting and complex world of real estate capital expenditures.

FAQs

What is a capital expenditures in real estate?

A capital expenditure in commercial real estate refers to a significant financial outlay made to acquire, improve, or extend the useful life of a property. These expenditures are typically long-term investments aimed at enhancing the property’s value or generating income, rather than regular maintenance or operational costs.

What are the benefits of investing in capital expenditures in real estate?

The benefits of investing in capital expenditure for commercial real estate include:

- Increased Property Value: Capital expenditures, such as renovations or upgrades, can significantly enhance the property’s market value, attracting potential tenants and buyers.

- Attracting Tenants: Improvements can make the property more appealing to potential tenants, leading to higher occupancy rates and rental income.

- Competitive Advantage: Investing in modern amenities or energy-efficient systems can give your property a competitive edge in the market.

- Potential for Higher Rents: Upgraded properties can command higher rental rates, potentially increasing your rental income.

- Tax Benefits: Some capital expenditures may be eligible for tax deductions or depreciation, reducing your tax liability.

What are the risks associated with capital expenditures in real estate?

Risks associated with capital expenditure in commercial real estate include:

- Cost Overruns: Construction or renovation projects may exceed budget estimates, potentially impacting the property’s overall return on investment.

- Economic Downturn: Market conditions can change, affecting the demand for upgraded properties and rental rates.

- Tenant Turnover: There’s a risk that tenants may not renew leases after improvements, leading to vacancy and income loss.

- Regulatory Changes: New regulations or building codes could impact the feasibility of planned capital expenditures.

- Financing Risks: Securing financing for capital projects can be challenging, and interest rates may fluctuate.

What are the most common capital expenditures in real estate?

The most common capital expenditure investments in commercial real estate include:

- Renovations: Upgrading interiors, exteriors, or common areas to attract tenants or improve aesthetics.

- Infrastructure Improvements: Enhancing plumbing, electrical systems, or HVAC to improve efficiency and tenant comfort.

- Energy Efficiency Upgrades: Installing energy-efficient features such as LED lighting, insulation, or solar panels.

- Technology Enhancements: Integrating smart building systems, security, and high-speed internet to meet modern tenant needs.

- Expansion: Adding square footage or new buildings to increase the property’s rentable space.

What are the tax implications of capital expenditure in commercial real estate?

The tax implications of capital expenditure in commercial real estate can vary depending on the jurisdiction and specific circumstances. Generally:

- Depreciation: Capital expenditures can often be depreciated over time, allowing property owners to deduct a portion of the expenses each year, reducing taxable income.

- Section 179 Deductions: In some cases, the Tax Cuts and Jobs Act allows immediate expensing of certain capital expenditures, offering potential tax benefits.

- 1031 Exchange: Capital gains tax on the sale of a property can be deferred by reinvesting the proceeds into another like-kind property through a 1031 exchange.

- Interest Deductions: Mortgage interest related to capital improvements may be tax-deductible.