Property technology (proptech) is revolutionizing the way buildings are managed, valued, and experienced, and real estate investors are paying attention.

Why? Because these digital upgrades don’t just create better tenant experiences—they directly impact your bottom line through improved Net Operating Income (NOI).

If you want to let better technology upsell your property, this blog is for you. This article explores the amalgam of Proptech and NOI, and how they can help you save and earn more money through one-time investments in technology.

Table of Contents

- Proptech: The Intersection of Real Estate and Technology

- Understanding Net Operating Income (NOI)

- Why Invest in Proptech in 2025?

- How Access Control Systems Drive NOI Growth in Multifamily Properties

- Emerging Trends in Real Estate

- Your Best Purchase To Boost Your Property’s NOI

- Frequently Asked Questions

Also, Read

- The Best Apartment Security Systems for 2025 (Checklist Included)

- Why Invest in an Automated Gym Access Control System in 2025

- Choosing A Smartphone Gate Entry System

- myQ Smart Home: A Comprehensive Customer-Centric Review

Proptech: The Intersection of Real Estate and Technology

Proptech is used to describe any digital innovation that can help enhance real estate operations and experiences. It’s a modern-day bridge between building management practices and cutting-edge technology, evident through AI-powered property management platforms and IoT-enabled smart building systems.

But here’s what many people don’t realize: proptech isn’t just about incorporating every new gadget or technology you come across. It’s about choosing a future-proof product that creates actual value—one that shows up directly in your property’s NOI.

Proptech covers everything— from tenant acquisition to financial analytics, and the reason it’s a game-changer is that it’s able to address pain points that have plagued the industry for years (inefficient building management, unhappy tenants, limited data insights, and more).

Despite solving major concerns for real estate professionals, the biggest motivator for the adoption of proptech is undoubtedly its impact on the NOI of a building.

Understanding Net Operating Income (NOI)

NOI is arguably the most important metric to you if you work in real estate. It’s the annual income generated by a property after deducting operating expenses, but before accounting for taxes, financial costs, and depreciation.

For calculation, you can simply take your total revenue (which includes rental income, parking fees, laundry and vending revenue, etc.) and subtract your operating expenses from it (building monitoring and management fees, maintenance costs, utilities, insurance, etc.).

Why NOI Matters More Than Ever

While there are many ways to calculate your property’s value, one important formula involves dividing your property’s NOI by its capitalization rate (where NOI is Net Operating Income in real estate and capitalization rate represents the property’s potential rate of return).

Hence, the larger your property’s NOI, the more valuable it is, owing to better cash flow and thereby stronger returns for investors.

Here is where proptech can really help. With advanced technology and increased automation, you’re able to cut down on operating expenses and even generate new income streams. This leads to a powerful multiplier effect on your NOI, subsequently enhancing the value of real estate.

Why Invest in Proptech in 2025?

The global proptech market is experiencing explosive growth, with Fortune Business Insights projecting expansion from $36.55 billion in 2024 to $88.37 billion by 2032. Some forecasts are even more optimistic, with Precedence Research predicting the market could reach $179.03 billion by 2034, representing a compound annual growth rate of 16%.

This isn’t just growth for growth’s sake. The surge in proptech investment reflects real, measurable benefits that property owners and managers are experiencing.

Here’s why 2025 is the ideal time to embrace proptech in all your properties.

Revenue Enhancement

Smart building systems of today can help you significantly offload by automating previously manual processes and making users more independent in managing their own and visitor access. With the advent of smart lockers and package management systems, as well as concierge services, you can easily build new income streams. These digital facilities help you command premium rents and improve tenant acquisition and retention.

Operational Efficiency

The most immediate impact on NOI comes from operational cost reductions. When you implement automated building systems, you cut costs by approximately 20-30%. By integrating predictive maintenance software, you can also prevent hefty emergency repairs and extend equipment life. Advanced property management systems are immensely helpful in live monitoring, loitering detection, automated rent collection, and instant communication—all of which slash labor hours and costs.

Market Differentiation and Competitive Advantage

A proptech-enabled building creates a perception of modernity, cutting-edge facilities, and a smarter home. Tenants are willing to pay higher rents for such amenities and are generally more satisfied with the increased convenience and security that such new-age homes bring. Having a tech-forward property is also a direct advantage if you are considering investors in the future.

Future-Proofing Your Investment

Going forward, users are going to expect seamless and complete digital experiences. By today’s investment in proptech, you are not just improving the current technological infrastructure of your real estate, but also ensuring a long-lasting advantage against competitors and carving higher valuations for the future.

How Access Control Systems Drive NOI Growth in Multifamily Properties

One of the easiest roadmaps to higher NOI is investment in access control systems. In all types of properties, especially multifamily and commercial buildings, access control devices are the beacon of technological infrastructure and a key investment area.

Let’s explore the dual-pronged approach of investing in access control systems and boosting your NOI.

Security Drives Revenue

Beyond just managing who enters the building, today’s access control systems encompass package management, video surveillance, verification, and smart alerts for any activity near the door. Such premium amenities rake in higher rent amounts as tenants find value in greater convenience and autonomy in managing their own security.

Reduced Operational Costs

There are simply too many expenses associated with traditional lock and key systems (rekeying expenses, damaged locks, maintenance). Smart intercom systems not only slash these costs, but they also free up site staff from mundane tasks and channel their work hours more productively. Modern infrastructure is a great investment that pays off through low maintenance costs, reduced security breaches, and a smoother administrative workflow.

Tenant Experience and Retention Impact

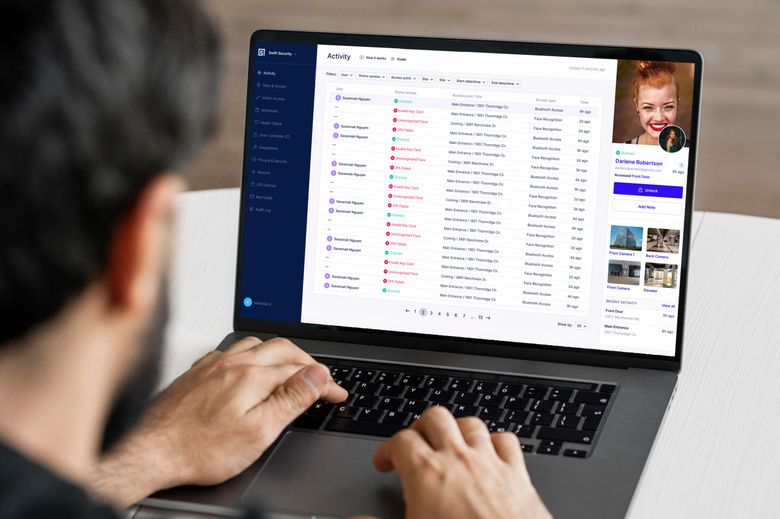

When tenants feel secure and enjoy convenient access, they’re more likely to renew leases and recommend the property to their circle. With mobile-based entry, smooth visitor management, minimal downtime, and smart-home integration, tenants find everything they want under the umbrella of one phone-based application or desktop dashboard.

Integration and Scalability

Tenant needs and demands continue to change as newer technology evolves. To make sure your real estate remains competitive, you need to set a foundation that’s flexible enough for broader proptech integration, such as smart home systems (Google Home, Amazon Alexa), smart locks, lighting/ temperature control, and more. Current systems are also highly scalable, so you can easily branch out into additional buildings or property portfolios using the same single dashboard as before.

Emerging Trends in Real Estate

The proptech landscape is positioned for rapid year-on-year growth. We’ve compiled a list of upcoming real estate technology trends that will shape this transition and help you stay ahead of the curve while maximizing your NOI potential.

Artificial Intelligence

The AI market in real estate is projected to reach $988.59 billion by 2029. We are witnessing the transition of AI from its experimental phase to practical use cases in nearly every industry. Real estate is no exception.

- 63% of real estate professionals credit AI with massive revenue increases through the automation of day-to-day tasks like tenant screening and lease management.

- Going forward, you’ll find AI leading all central property management tasks—from predictive maintenance to data analytics and optimal energy usage.

- AI virtual assistants are also gaining traction in offering customer support, handling leasing queries, scheduling property tours, and more.

Internet of Things (IoT)

IoT in general and in real estate works by bringing technologies together and making their functions “smarter”.

- IoT sensors are a huge goldmine for insights as they allow you to monitor air quality, energy usage, foot traffic, and much more, to help you predict maintenance, optimally use energy, and enhance tenant experiences.

- In residential and commercial spaces, IoT sensors help manage personal and building-wide security. They use mobile-enabled entry methods, facial recognition checks, and motion detection.

Virtual and Augmented Reality (VR and AR)

VR and AR technologies are changing the way properties are toured and leased. Showing the place around on a phone brings down the cost of a physical look-around while also reaching a larger audience.

- Interested people can now opt for interactive virtual tours 24/7 from the comfort of their homes. They can visualize themselves in the space, which helps them make more informed decisions about their investment.

Sustainable Technology

Energy-efficient properties that reduce waste and run on green energy offer a quick and effective way to achieve better NOI and become a high-value investment.

- Sustainable building technologies deliver measurable cost savings and build competitive positions.

Big Data Analytics

If you own any business and don’t use big data analytics for analysis and decision making, you’re voluntarily losing to the competition. This technology can process vast datasets to identify customer patterns and real estate technology trends, helping to understand consumer behavior.

- In real estate, one can anticipate market fluctuations and adjust one’s selling strategies accordingly. For example, McKinsey’s research found that machine learning can predict rent rate changes with 90% accuracy, and other property metrics with 60% accuracy.

Blockchain Technology

Blockchain technology changes the way real estate is owned and transferred through the tokenization of assets and a transparent mechanism.

- Property managers and owners can reduce transaction time and costs by utilizing tamper-proof digital ledgers, which minimize the chances of fraud and eliminate intermediaries.

Your Best Purchase To Boost Your Property’s NOI

Swiftlane’s access control products deliver measurable returns because every upgrade isn’t just an upgrade; it’s an investment in the future.

The Swiftlane video intercom and credential readers allow premium rent positioning while creating opportunities for additional revenue streams through integrated services and amenities.

You slash basic purchase and maintenance costs for keys/ fobs, as well as reduce on-site staff through automation and greater resident control over their security.

Our clients typically see ROI within 12-18 months of switching. Check out what they say.

Frequently Asked Questions

What is proptech for real estate?

Proptech, short for “property technology,” encompasses all the digital tools, software, and innovations that are transforming how we buy, sell, manage, and invest in real estate. We’re talking about everything from AI-powered property valuation tools and virtual reality tours to smart building management systems and blockchain-based transactions.

What does NOI mean in real estate?

Net Operating Income in real estate is basically the number that tells you how much money a property is actually making after you pay all the bills to keep it running. Unlike other financial metrics that can be influenced by how you finance a deal or tax strategies, NOI gives you the pure operational performance of the property itself.

How to calculate NOI?

To calculate NOI, subtract all operating expenses incurred on a property from all revenue generated.

Here’s the simple formula: NOI = Total Revenue – Operating Expenses

Let’s say you own a small apartment building that generates $120,000 in annual rent (includes parking fee, laundry income, and similar streams of income). Your monthly operating expenses include property management ($800), maintenance and repairs ($600), insurance ($300), utilities you pay ($200), and property taxes ($1,000). That’s $2,900 per month, or $34,800 annually, in operating expenses.

Your NOI would therefore be $85,200.

What is included in NOI calculation?

Getting the NOI calculation right means knowing exactly what counts as revenue and what qualifies as an operating expense. Let me break this down so you don’t accidentally inflate or deflate your numbers.

| Revenue Includes | Operating Expenses Include |

| Base rent from all tenants | Property management fees |

| Parking fees and garage rentals | Regular maintenance and repairs |

| Laundry machine income | Property insurance |

| Pet fees and deposits (when non-refundable) | Utilities (when paid by the owner) |

| Late fees | Landscaping and snow removal |

| Application fees | Property taxes |

| Storage unit rentals | Marketing and advertising costs |

| Legal and professional fees related to operations | |

| Supplies and equipment for maintenance |

What’s NOT included in NOI: Net Operating Income in real estate typically excludes owner-specific expenses, such as debt service, income taxes, and depreciation, as well as irregular capital expenditures, including tenant improvements and major repairs or replacements.

NOI is a before-tax figure, appearing on a property’s income and cash flow statement, that excludes principal and interest payments on loans, capital expenditures, depreciation, and amortization.

Does NOI include property taxes?

Yes, property taxes are included in your NOI calculation. Here’s the logic: Property taxes are a direct cost of owning and operating the property. Whether you pay them monthly through an escrow account or annually in a lump sum, they’re as much a part of your operating expenses as insurance or maintenance. The property generates income, and a portion of that income must be allocated toward the taxes required to keep the property legally operational.

What are the advantages of proptech integration?

The primary advantages include increased NOI through higher revenues and lower costs, improved tenant satisfaction and retention, enhanced operational efficiency, better data insights for decision-making, reduced risk through improved security and predictive maintenance, and future-proofing your property investment.

Upgrade Your Building Security

Get in touch with a Swiftlane specialist for more information on the best access control and video intercom solution for your building.